Highlights from the 2019 DFS State of the Market Report

What’s going on with DFS in Nigeria? And what’s the update on that widely reported gender gap?

The 2019 DFS State of the Market Report was launched on November 28 to much excitement.

Since 2016, the DFS State of the Market series has been the flagship publication of the SIDFS and continues to present an overview of the DFS landscape from demand and supply side perspectives, offering insights and analysis of relevant data sourced from across the ecosystem.

This year, we dug deeper into the consumer data to unearth insights about the widening gender gap, as well as to update the consumer profiles of the banked, underbanked and unbanked populations. We also reviewed the progress of the policy recommendations we made in the 2017 State of Market report.

Here are some of the interesting insights we found:

Financially excluded households are typically large.

One of our interesting findings was that members of large households do not access either formal or informal financial services. While the proportion of unbanked living in households of three members or less reduced between 2017 and 2018, the number of unbanked adults living in households of five or more members significantly increased between 2017 and 2018. This is also true for the under-banked and banked categories.

With rising levels of unemployment especially among the youth, increasing levels of dependence could be a factor driving rising household sizes.

These households may need poverty alleviation interventions to increase the amount of income available to them. We also believe that financial literacy will influence their ability and willingness to plan their finances better and to utilise financial services and products.

Many adults living above poverty lines are financially excluded or use only informal financial services.

It was previously assumed that people living below the poverty line were the only ones financially excluded. However, that is not the case. We discovered that a significant number of adults live above the poverty line but remain financially excluded or use only informal financial services. These adults earn above 730 Naira (US$2) per day (or 21,900 Naira (US$60) monthly) but are still financially underserved or excluded altogether.

We believe this suggests a product-market mismatch and is an immense opportunity for FSPs to invest in appropriate financial services accessible to these economically active adults.

A large percentage of the under-banked and unbanked own mobile phones.

We see this as a huge opportunity for financial inclusion.

The mobile phone has been an enabler for adults to access diverse financial services . Based on EFinA 2018 data, about 10 million under-banked and 17 million unbanked adults own mobile phones. We also have 24.1 percent of all bank account holders having or using USSD codes for banking transactions.

With an increasing adoption of USSD banking, leveraging the ubiquitous mobile telephone can be a low hanging fruit for including the excluded segments especially in remote locations where broadband penetration is low. Further understanding of the peculiarities and needs of these excluded populations will be helpful in developing financial products and services that may be well-received by them.

More women than men are financially excluded, and the margin is increasing.

The gender gap is widening both in the under-banked and unbanked categories even as young women are the most vulnerable group to be financially excluded.

They are typically within the age bracket of 18 and 34. Considering that this is arguably the most productive age range, it is a big dent on the country’s human capital.

Closing this gap would require deliberate action from the ecosystem, for instance, providers becoming gender-intentional in their development and delivery of financial products and services. Financially excluded women also need to be the target of more empowerment programmes.

Under-banked adults are saving more.

We noticed some interesting developments in financial services penetration. While access to savings among the banked adults remained unchanged, more people in the under-banked and unbanked categories saved more. This suggests that economic activities improved in the informal sectors.

Alternatively, while there was an increase in the informal savings rate, access to informal credit declined. There was however a significant increase in people accessing formal credit (up to 56.4 percent of the banked population). Possible explanations are the increased activities of digital credit providers and the government’s micro-credit schemes.

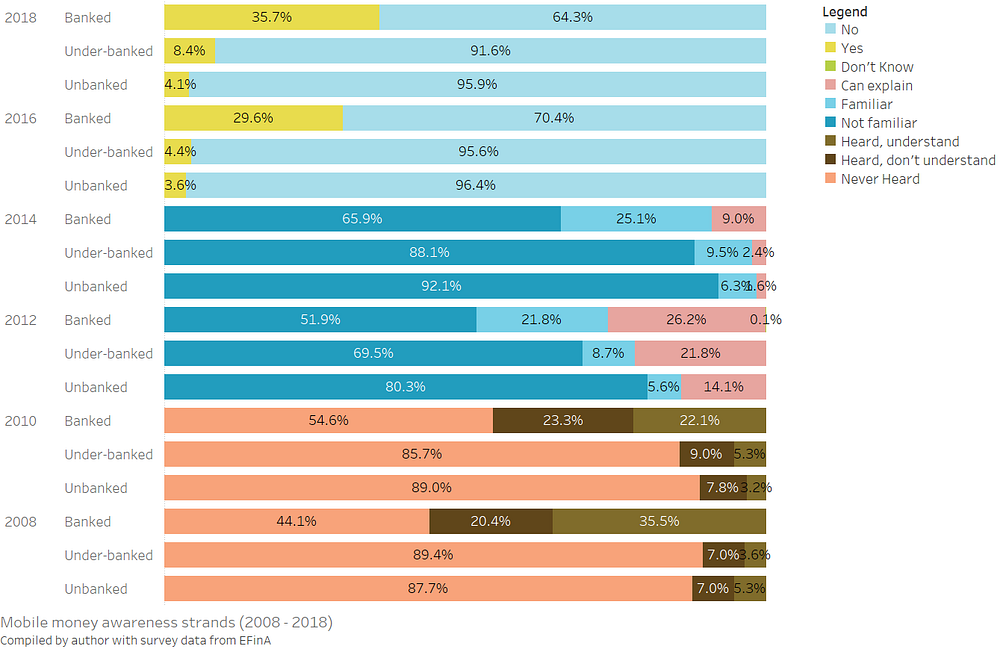

Mobile money remains unpopular.

There was minimal improvement in mobile money usage while mobile money awareness remains very low among the under-banked and unbanked populations. The latest data shows that only 4.1 percent of the financially excluded and 8.4 percent of the under-banked are aware of mobile money services (Figures 6 and 7).

On the upside, transaction data from the Nigerian Interbank Settlement System (NIBSS) reveals that mobile as a channel is increasingly gaining acceptance. 9.3 million adults (or 24 percent of bank account holders) use the USSD services via their mobile phones for banking transactions.

Most financially excluded households have a single income source.

- Women constitute the majority of the underserved and financially excluded.

The 2019 DFS State of Market report is a treasure trove of insights on the Nigerian DFS market. Containing a progress report on the policy recommendations made in 2017 till date, consumer insights and a deep dive into the gender gap, it remains a valuable source of insights to inform decision making and thought leadership to guide the ecosystem on its journey towards a truly inclusive reality.