Payment Service Banks: All You Need to Know (from 2018 — 2020)

It took 2 years but finally, the Central Bank of Nigeria (CBN) has granted final licenses to 3 Payment Service Banks.

A Quick Recap….

Experts and stakeholders have identified the exclusion of telcos from leading the provision of financial services as a major reason for the minimal progress in financial inclusion.

In 2018, the CBN created a ‘window’ for other players, including telcos, to lead financial service delivery via the release of guidelines for a new bank category — Payment Service Banks.

While there were several applicants for the new license, almost a year later (October 2019), 3 companies were granted approvals in principle (AiP).

Hope PSB, Moneymaster and 9PSB.

Fast forward to almost another year later, those 3 companies have finally been granted final licenses, having met all necessary criteria.

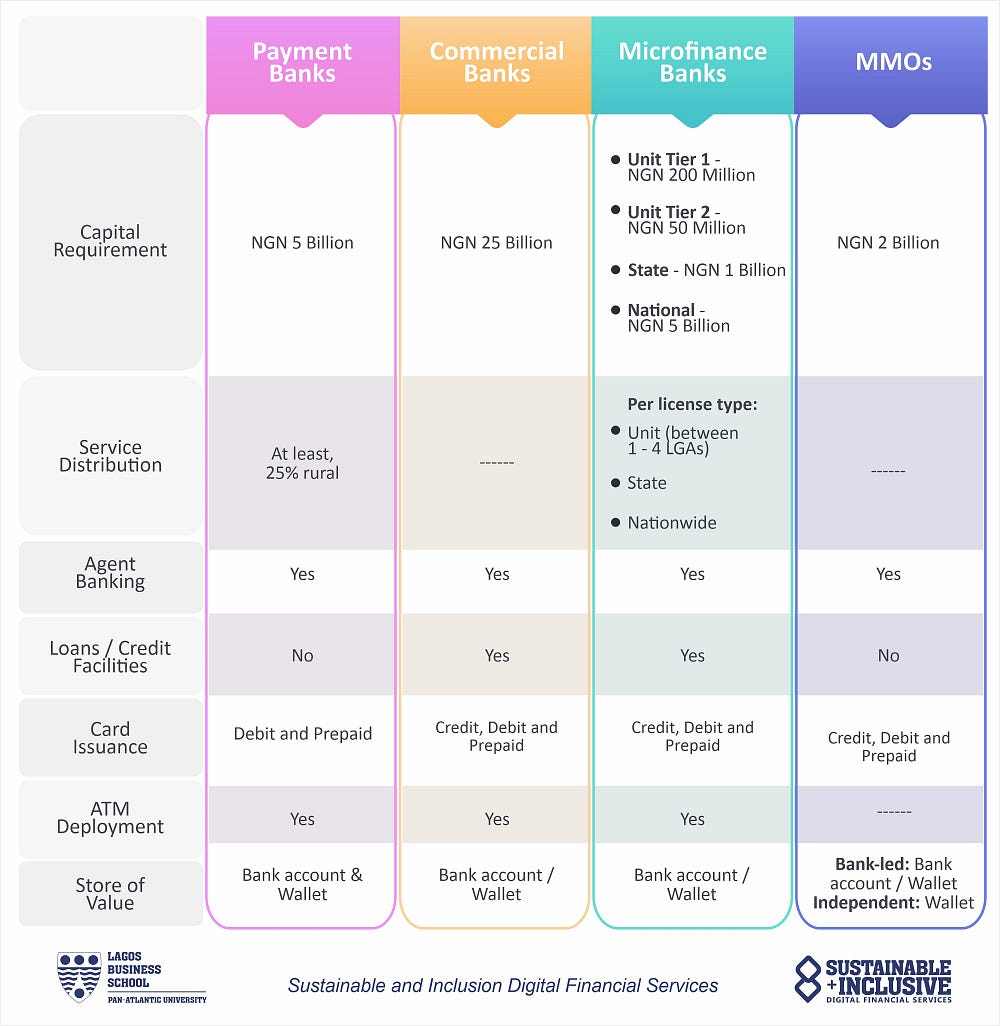

Payment Service Banks (or simply Payment Bank as they are called in India), is a relatively new bank category with smaller scale operations and the absence of credit risk. In addition to accounts (current and savings), PSBs can also offer payments and remittance services, issue debit and prepaid cards, deploy ATMs and other technology-enabled banking services. (We’ve written about Payment Service Banks before and also explored their origin in India).

Updated Guidelines

Between 2018 when the first guidelines were released and Q3 2020, when PSBs were granted final licenses, the guidelines have been reviewed and updated in the following ways:

- Switching companies are now included on the list of entities that can apply for and operate a PSB license.

- To enable fair competition, the parent or associated entities of a PSB are forbidden from discriminatory or differential pricing in products and services offered to other PSBs and CBN licensed institutions. (This had been implied in the old guideline but has been emphasised with more detail).

- PSBs are to interface with the Nigeria Inter-bank Settlement System (NIBSS) platform in order to promote interconnectivity and interoperability.

- Rate of charges: PSBs are to adhere to the CBN’s Guide to Charges by Banks, Other Financial and Non-bank Institutions.

KYC: A Potential Bottleneck

The new guideline states that PSB customers under the tier-1 account category shall require name and phone number as identification requirements. If this translates to tier-1 account holders requiring only these two elements to fulfil KYC requirements, it gives momentum to the onboarding process.

However, some stakeholders anticipate that this may cause some problems in the near future especially if the CBN mandates PSB account holders in all KYC tiers to have BVNs as it did with commercial and microfinance banks.

If you recall, in 2017 when the CBN reviewed the KYC requirements for mobile money wallets, it also clarified that mobile money wallet holders on KYC tier-1 are not required to provide a Bank Verification Number as part of the KYC documentation.

The need may arise once again for further clarification on whether PSB customers with tier-1 accounts require a BVN (or not).

Are PSBs the Magic Bullet?

The objective behind the licensing of PSBs, according to the CBN, is to “enhance financial inclusion by increasing access to deposit products and payment/remittance services to small businesses, low-income households and other financially excluded entities through high-volume low-value transactions in a secured technology-driven environment.”

In business terms, we could say the entry of PSBs into the market is to further the digitisation of the financial ecosystem at the bottom of the pyramid & the informal sector, which is where most of the excluded population are. This gives PSBs the opportunity to become the primary champions of financial inclusion for those customer segments.

There’s obviously a lot of excitement in the financial inclusion space (we’re excited too) and the next few months should be interesting.