Product Development Diaries: Lessons from Building Solutions for Low-income Bank Customers

How Customer Journey Mapping helped this Nigerian bank identify an underserved customer segment and boosted their loan portfolio

The fourth cohort of our Product Development Lab kicked off in February 2022.

Since 2020 when the Lab launched, 11 financial service providers (FSPs) have passed through the Lab with the intent to create new DFS products or tweak underperforming ones. Supporting these FSPs on their respective journeys, from ideation through to prototype, remains an exciting experience. Particularly encouraging is the diversity of product ideas that participating teams have come up with. These include a savings product and a loan facility for female entrepreneurs and MSMEs, a savings wallet with ecommerce functionalities, a digital marketplace for agro-allied products and so on. The evolution of these solutions was iterative and economical, further reinforcing our conviction of the importance of design thinking approaches to product development.

Below are some of our learnings so far.

Building a new product from scratch is not always the answer

Developing and launching products is the bread and butter of FSPs so it’s no surprise that most FSPs come to the Lab to create new products from scratch. However, the solution to their problems have not necessarily required rebuilding from zero, as one of our participating institutions discovered.

The problem:

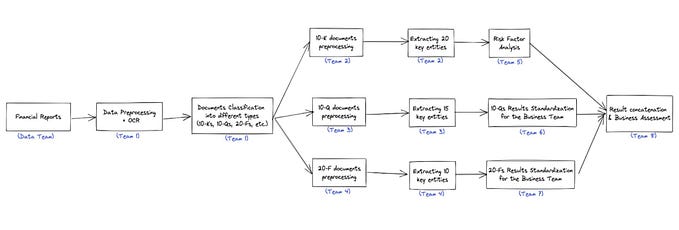

In cohort 2, one of our participating institutions (let’s call them FSP A) planned to grow their MSME loan portfolio by at least 200 percent and thus, wanted to create a new loan product targeting low-income market women. Their major challenge was managing the risk of defaults.

The insight:

During the concept testing stage*, when we visited several local markets to interview the target customers, we made a few interesting observations:

First, some of the women interviewed were participating in FSP A’s weekly savings program. This was a program that had been custom made for market women, and every Thursday, an account officer would physically visit the market women in their stalls to collect and log their deposits.

Secondly, these women save between N20,000-N40,000 ($US45-$US90) every month and had been doing so with their account officers for almost 2 years (on the average, the women had saved up to about N300,000). However, according to these women, they had tried several times and failed to secure loans from FSP A due to cumbersome and often confusing requirements.

During the daily downloads (i.e. stand-up sessions at the office where team members share and discuss their field observations), it became clear that these women were underserved (based on their consistency with the savings program and monthly business turnover). They definitely ticked the right boxes to receive MSME loans. Thus, the task became figuring out ways to lower or eliminate the barriers these women faced.

This revelation also made us wonder how many FSPs are sitting on troves of customer data, waiting to be sorted and analysed for critical insights. From our experience, many commercial and microfinance banks are yet to properly segment their customers to identify opportunity markets.

The solution:

After several brainstorming and iterations mapping the customer journey, the team came up with several solutions. The most viable involved leveraging the strong relationship between the women and their account officers, engaging the account officers as distributors/channels through which the women secured the loans they needed.

Achieving this required:

- digitising the deposit collection and bookkeeping process (the account officers did this manually)

- building a customised credit check system for market women

- enable the account officer crosscheck credit worthiness, and explain the available loan offers generated by the system

- Securing loan approvals within 24 hours and deducting loan repayments from weekly savings

The team spent a few days storyboarding and working on prototypes to ensure the solution was convenient for both the account officers and customers with plans underway to run a pilot program in the coming weeks/months.

And that’s the beauty of the human centered design process. HCD emphasises understanding user behaviour and using that understanding to design solutions that are not only relevant but can be improved incrementally over time. We also incorporate our Customer Segmentation Framework into the Lab, ensuring that FSPs can intelligently identify customers with similar characteristics and psychographics, which enhances personalisation, marketing efforts and so on.

Outcomes like we had with FSP A reinforce our conviction in design thinking and customer-centricity as an efficient path to developing solutions that customers use and love and which will ultimately impact FSPs’ bottom line.

“When you understand the people you’re trying to reach — and then design from their perspective — not only will you arrive at unexpected answers, but you’ll come up with ideas that they’ll embrace.” ~ IDEO

We’re excited for the future of the ecosystem, especially as more FSPs embrace design thinking to build products that customers love.

Interested in joining the next cohort? You can reach us at sustainabledfs@lbs.edu.ng

*Concept testing is a stage in the Lab where the product team goes into the field to interview existing and/or prospective customers to understand their needs, psychographics and financial realities.