Financial Inclusion and Financial Health in Nigeria

Financial inclusion is attracting the attention of theorists and practitioners in financial services development as evidence continues to link it to economic growth, development and poverty reduction.

In the past few years, financial inclusion has risen in popularity, with its role in attaining the United Nations’ SDGs becoming more and more emphasized. Today, it is agreed that financial inclusion is an enabler and an effective lever through which the 19 SDGs in the 2030 developmental goals can be actualised. The logic is that being financially included leads to improved financial status as it grants people, particularly the vulnerable, marginalised etc, the tools they need and a lifeline to resources which can improve their welfare.

In a recent study, two of our resident researchers — Professor Yinka David-West and Dr Olubanjo Adetunji — explored the relationship, if any, that exists between financial inclusion and financial health. In this article, we discuss some of their findings:

Defining Financial Health

The Financial Health Institute defines financial health as the dynamic relationship of one’s financial and economic resources as they are applied to or impact the state of physical, mental and social well-being. To put this in another way, financial health refers to an individual’s financial situation that determines how much that individual saves, if the person has a pension, or how much of the person’s income goes into fixed or non-discretionary expenses.

Over the years, researchers have been able to show the influence of financial health (also referred to in literature as financial well-being) on mental health and even marital relationships. Financially healthy citizens are necessary in any economy as their presence affects economic growth and development. Therefore, a positive relationship between financial inclusion and financial health makes a case for developing countries to use access to finance as a strategic policy imperative to catalyse economic growth and development.

METHODOLOGY

This study examined the relationship between financial inclusion and financial health. Data was sourced from the annual Intermedia’s Financial Inclusion Insights (FII) financial landscape survey for Nigeria conducted in 2017.

Respondents were in three categories:

Measuring Financial Health

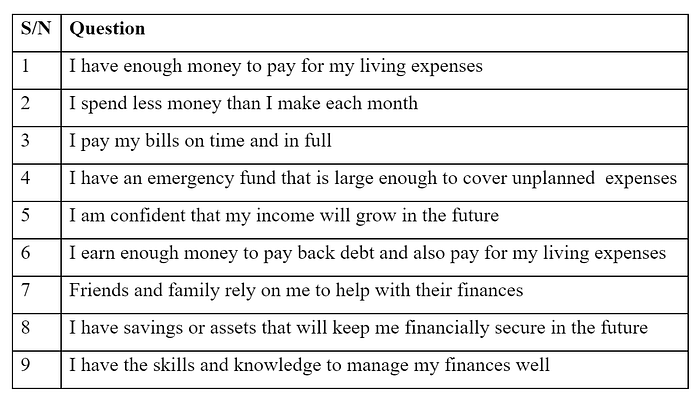

We attempted to develop a financial health index using responses to questions that measured the respondents’ net financial position, access to potential resources for debt payments and financial shocks and the respondents’ confidence about present and future financial conditions (the full list of questions are in the table below).

The respondents’ answers to the questions were weighted and scaled into quintiles from the lowest quintile of ‘very financially unhealthy” to the highest quintile of “very financially healthy”.

RESULTS AND DISCUSSION

Figure 1 shows the distribution of financial health status in Nigeria.

Figure 1

It shows that 9 percent of adult Nigerians are very financially unhealthy while an additional 31 percent are somewhat financially unhealthy. Only three percent of adult Nigerians in the top quintile are regarded as very financially healthy. Compared to others in the lower quintiles, these Nigerians (the 3 percent) have enough money to pay for their living expenses and have emergency funds large enough to cover unplanned expenses. These very financially healthy Nigerians are also very confident about their financial positions in the future.

A breakdown of the financial health status by financial inclusion category is shown in Figure 2.

Figure 2

The figure shows that the banked adult Nigerians are financially healthier than the average Nigerian. While four percent of the banked adults are very financially unhealthy, 14 percent of unbanked Nigerian adults without access to either formal or informal financially services are very financially unhealthy. Additionally 35 percent of the unbanked adults are somewhat financially unhealthy and thus about half of unbanked adult Nigerians are either somewhat or very financially unhealthy. The results suggest a link between financial inclusion and financial health of adult Nigerians and show that financially included adult Nigerians are likely to be financially healthier than the financially excluded adults. The financial health status of the under-banked who use only informal financial services provided by cooperative societies and saving groups is in-between that of the banked and the unbanked. The financial health status of the under-banked reflects that of an average adult Nigerian with the banked likely to be financially healthier than the under-banked while the unbanked adults are more likely to be financially unhealthy than the under-banked.

CONCLUSION

The results from this study strongly suggest that financial inclusion has a strong relationship with financial health. Therefore, ongoing efforts to improve financial inclusion will not only bring more people into the formal financial system but also improve the financial health of those Nigerians that are now banked. The research also suggests that financially included adults are more likely to plan their finances better than the unbanked and thus better able to manage financial shocks and more confident about their future financial positions. Efforts to onboard excluded and informally served citizens are not misguided and are likely to have a lasting impact on the beneficiaries, based on the results of the analysis.